“Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.” -John Wanamaker

Digital advertising has been hailed as the data driven marketer’s dream– but what many advertisers are discovering is that measurement provides a much more pessimistic view in regards to digital ROI. When billion dollar CPG companies with staffs of PhD statisticians and highly credentialed marketers are unable to justify ad spend, it makes it that much more difficult for small and mid market businesses to expect positive results from digital marketing. Video advertising, led by the offerings from Youtube and Facebook, is estimated to be a $17 billion+/year market, growing at over 10% per year. This is great for the walled gardens who are able to capture 45% of ad revenue for providing a platform and infrastructure, leaving advertisers to determine if video ads are effective at driving brand recognition or direct response conversions. If the former, then the primary performance metric should in theory be optimizing for the lowest CPM across traditional broadcast and digital video. With that, we’ll start looking into relevant information regarding the actual efficacy of digital video advertising.

Do You Get What You Pay For?

The question of “Do video ads work?” should be prefaced with “Do I actually get the video ads I am paying for?” simply for the fact that both Facebook and Youtube tend to over-report viewership figures. Facebook has since became Media Rating Council certified, but given their history of data *security*, it makes sense to be somewhat suspicious regarding reporting integrity. Google’s introduction of Trueview Ads around 2016 are a step in the right direction regarding measuring actual ad views, rather than just a tag firing upon page load.

Measuring Impact

The background is now set, so I’ll step off the Soapbox of SuspicionTM and get to the actual study and implied data.

Google created a fake pizza brand to test out creative strategies for YouTube ads

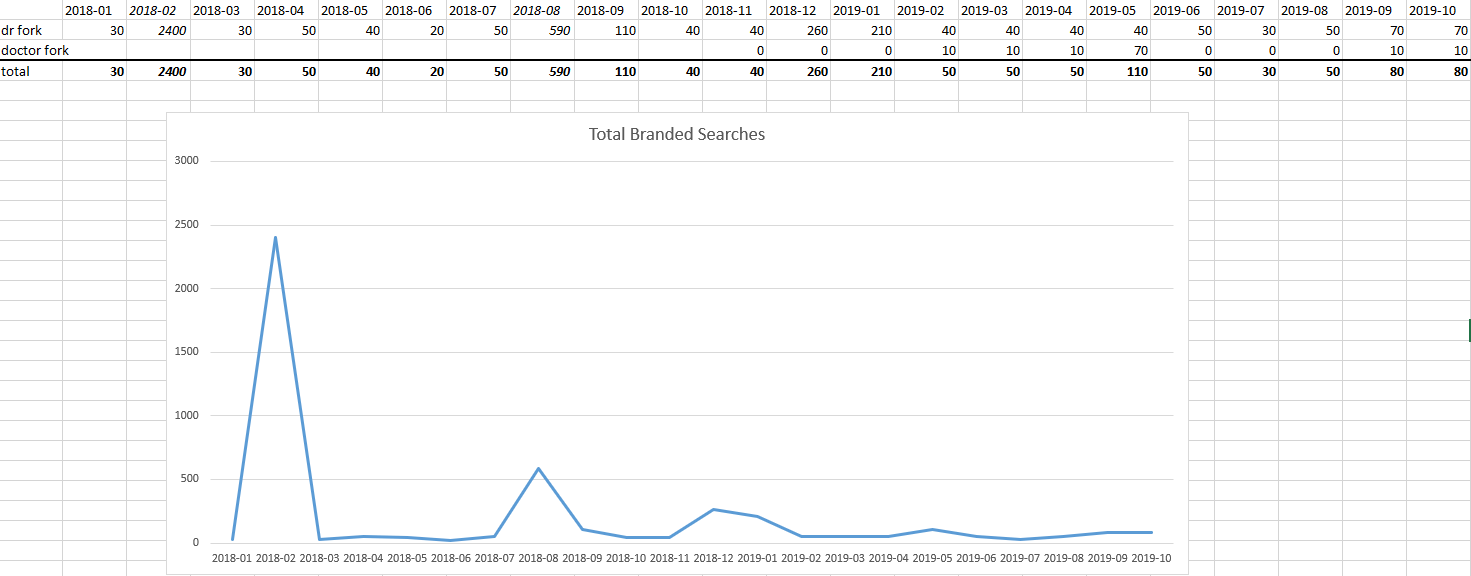

The above story by TechCrunch details the conditions of the experiment in depth. Essentially, Google gifted a $200k AdWords voucher, which in turn bought 20 million impressions to create an ad hoc Youtube video campaign for a fictitious pizza brand. They make no mention of engagement, instead focusing on qualitative metrics. The experiment was conducted in February 2018, and as you can see, 20MM impressions yielded ~2,400 branded searches (a proxy for high intent users, versus passive intent) with an immediate reversion to the mean (likely the actual Dr. Fork, MD) as soon as the ad flight stopped. Another spike occurred in August– attributable to the TechCrunch article. This 99% drop in consumers seeking out the brand after the ads stop airing may potentially mean a few different things: that digital video efficacy may not be highly useful for advertisers when not adequately targeted (think niche influencers vs broad appeal), that digital video is a supplementary marketing channel (use in addition to other channels) or possibly that digital video is already mature enough to be considered as interchangeable with legacy broadcast/subscriber based digital video (with a thin veneer of targeting options, equivalent to common sense show demographic estimates) with a higher CPM.

It all comes down to objectives. The advertiser’s goal should be to saturate the most cost effective channels first– with digital that will typically be search, due to the higher intent. In highly competitive verticals, exorbitant CPCs (and in turn, cost/conversion) will eat up margin, leading rational actors to search for more cost effective channels. Brick and Mortar locations have an inbuilt advantage when it comes to both overall visibility and local search opportunities. Some of Corgilytics tools provide immediate optimization opportunities for nearly every retail/B&M organization, so why not find out more by scheduling a demo?